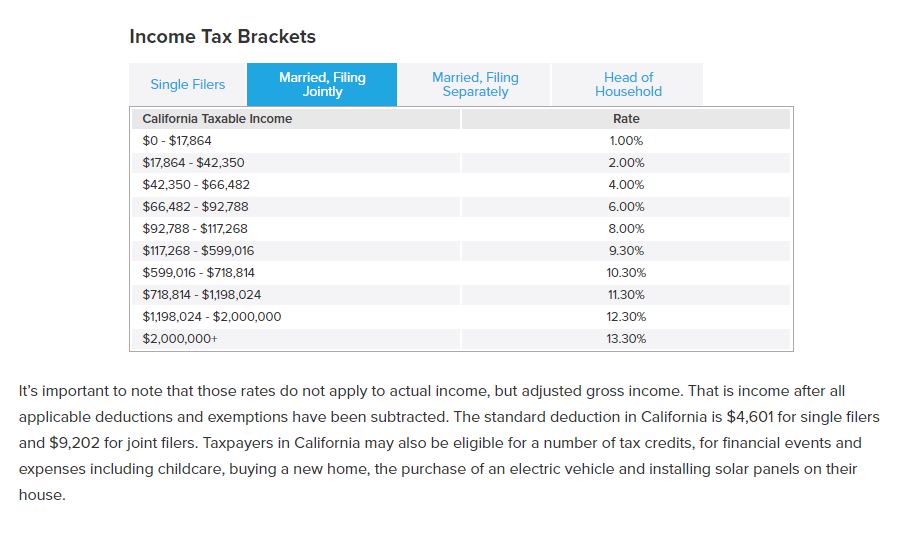

The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses. These taxes will be reflected in the withholding from your paycheck if applicable. Bonuses and earnings from stock options are taxed at a flat rate of 10.23%, while all other supplemental wages are taxed at a flat rate of 6.6%. In California, these supplemental wages are taxed at a flat rate. This includes overtime, commission, awards, bonuses, payments for non-deductible moving expenses (often called a relocation bonus), severance and pay for accumulated sick leave. SDI also provides California’s Paid Family Leave program. The maximum your employer can withhold for State Disability Insurance (SDI) is $1,601.60. If you earn money in California, your employer will withhold state disability insurance payments equal to 1.1% of your taxable wages, up to $145,600 per calendar year in 2022. This may seem like a drag, but having disability insurance is a good idea to protect yourself and your family from any loss of earnings you might suffer in the event of a short- or long-term disability. This won’t affect your paycheck, but it might affect your overall budget.Ĭalifornia is one of the few states to require deductions for disability insurance. However, sales tax in California does vary by city and county. If you are thinking about using a mortgage to buy a home in California, check out our guide to California mortgage rates.Ĭalifornia also does not have any cities that charge their own income taxes. While the income taxes in California are high, the property tax rates are fortunately below the national average. California’s notoriously high top marginal tax rate of 13.3%, which is the highest in the country, only applies to income above $1 million for single filers and $2 million for joint filers. So if your income is on the low side, you'll pay a lower tax rate than you likely would in a flat tax state. The state has ten income tax brackets and the system is progressive. So what makes California’s payroll system different from the systems you might have encountered in other states? For one thing, taxes here are considerably higher. Instead, it requires that the filer enter specific dollar amounts, and it uses a five-step process that lets you enter personal information, claim dependents and indicate any additional income. This version removes the use of allowances, along with the option of claiming personal or dependency exemptions. The IRS also made revisions to the Form W-4. In recent years, the IRS released updated tax withholding guidelines, and taxpayers should have seen changes to their paychecks starting in 2018. The same goes for contributions you make to a 401(k) or a Health Savings Account (HSA). If you make contributions to your company’s health insurance plan, for example, that payment will be deducted from each of your paychecks before the money hits your bank account. Other factors that can affect the size of your paycheck in California or in any other state include your marital status, your pay frequency and what deductions and contributions you make. (Luckily, there is a deduction for the part of FICA taxes that your employer would normally pay.)

If you work for yourself, you’ll have to pay the self-employment tax, which is equal to the employee and employer portions of FICA taxes for a total of 15.3% of your pay.

California tax brackets full#

Your employer matches the 6.2% Social Security tax and the 1.45% Medicare tax in order to make up the full FICA taxes requirements. If you earn over $200,000, you’ll also pay a 0.9% Medicare surtax. Your employer withholds a 6.2% Social Security tax and a 1.45% Medicare tax from your earnings after each pay period. When calculating your take-home pay, the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. There may also be contributions toward insurance coverage, retirement funds, and other optional contributions, all of which can lower your final paycheck. The reason for this discrepancy between your salary and your take-home pay has to do with the tax withholdings from your wages that happen before your employer pays you. But unless you’re getting paid under the table, your actual take-home pay will be lower than the hourly or annual wage listed on your job contract. Your job probably pays you either an hourly wage or an annual salary. Number of cities that have local income taxes: 1.Median household income in California: $83,056 (U.S.California income tax rate: 1.00% - 13.30%.

0 kommentar(er)

0 kommentar(er)