If the original maturity term of the CD is more than one year, it will renew at the current interest rate for the next highest maturity term unless the original term is disclosed on the rate sheet. If the original maturity term of the CD is one year or less, it will renew at the current interest rate for the one-year CD. For CDs with terms of 14 days or less, you can withdraw your funds on the maturity date without being assessed a penalty.ĬD Specials – If the Time Account is a “CD Special,” it will renew for the exact term originally purchased. For CDs with terms of 15 days or more, you will have ten (10) calendar days from the maturity date to withdraw your funds without being assessed a penalty, or to notify the bank if you wish to change the rate and/or term of your certificate.

MONEY MARKET ACCOUNT PLUS

Open your Money Market account online or contact us with any questions.Withdrawal of Interest Prior to Maturity – The “Annual Percentage Yield” assumes interest remains on deposit until maturity and that a withdrawal will reduce earnings.Ĭompounding and Crediting Frequency – Interest will be compounded daily and paid at least annually (unless otherwise designated on the CD Account Agreement).Īccrual of Interest on Noncash Deposits – Interest begins to accrue no later than the business day we receive credit for deposit of non-cash items (for example, checks).ĭaily Balance Method Computation – We use the daily balance method to calculate your interest, applying a daily periodic rate to the collected balance plus earned interest.Īutomatically Renewable Time Account – This account automatically renews at maturity at the then current interest rate for the term selected. **Reaching ten or more transactions per month on your checking account: For a transaction to be counted, it must post to your 7 17 Credit Union checking account by the end of the current month and must be a monetary transaction, which can include, but is not limited to, deposits, transfers, cash withdrawals, cleared checks, online or mobile bill payments, and ACH payments balance inquiries and fees are not counted as a transaction.ħ 17 Credit Union provides banking services to the greater Warren, Kent, Ravenna, Canton, and Youngstown, OH, areas. Money Market Account gives the flexibility of a Call Deposit while retaining the high interest rate of a Time Deposit.

Money market accounts work like a savings account.

It's the ideal account for safeguarding larger deposits or building up emergency funds for unexpected expenses. You get a better rate than a regular savings account with more accessibility than a certificate. Earn higher interest than basic savings accounts along with the convenience of.

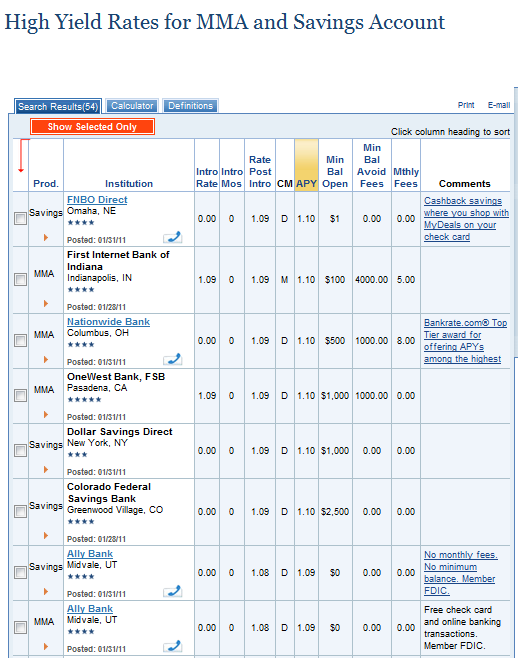

Ready to boost your savings? Our Money Market accounts are high-yield options that reward you with higher dividend rates for larger balances. Our Money Market Account might be right for you if you want to earn interest, but need access to your cash via ATM, Debit and checks. Travis Credit Unions Money Market Accounts give you the best of both worlds. The larger your balance, the more you earn

0 kommentar(er)

0 kommentar(er)